FinTradeBooks Bookkeeping Services for Small and Medium-Sized Businesses

At FinTradeBooks, we believe that your books should work FOR you so you can work

on your business, not in your business. We work closely with our customers to build

compliant books that are accurate, and timely and give invaluable insight.

Our bookkeeping services span a comprehensive range designed to meet the unique

needs of our trade-based clients. Our foundational core is rooted in working with

trade organizations and the majority of our staff has direct hands-on experience

within trade companies before coming to FinTrade. While our services are uniquely

customized to meet your specific needs, we break down what we do into two primary

categories, the FinTrade tune-up and the FinTrade Maintenance Program.

Both FinTrade tune-up and FinTrade Maintenance each have various levels detailed

below, but basically, each higher level adds additional services to the prior.

TO BEGIN

The FinTrade Tune-Up:

Basic Tune-Up:

The basic tune-up is best for our newer and/or smaller organizations. Best for Cash-based customers and doesn’t contemplate addressing many historical accounting items other than through one entry at the agreed-upon period

close date.

Better Tune-Up:

Best Tune-Up:

The BASIC Tune-Up:

The basic tune-up is best for our newer and/or smaller organizations, It is for Cash based taxpayers only and not recommended for companies that are accrual, have more complex A/R, use Purchase Orders or have complex consignment or inventory relationships.. We start at the last closed tax period and go to the agreed-upon period (usually the prior month or quarter) This package includes:

- Reconciliation of all bank and credit card accounts.

- Implementation of a new chart of accounts (if applicable… usually good practice for business group

- members). We will make entries on the last closed period that will reflect the period covered in the tune-up to match the revised chart of accounts.

- Check and address basic problems with CRM/invoicing issues with most CRMs (if applicable), If these

systems are not linked, we will assist in mapping and provide a pathway to do so but this does not cover addressing historical invoices or AR translation between CRM and accounting books. - Review of Payroll Journal Entries or existing mapping. Will provide a plan to best practices for maintenance moving forward but does not address prior entries.

- Review and potential catch-up of Depreciation/Amortization entries.

The BETTER Tune-Up:

All the elements of the BASIC tune up plus a deep dive into the following areas

- Accounts Receivable (A/R) reconciliation that ties receivables back to your merchant services and bank deposits. It also includes getting an accurate Accounts Receivable balance at the agreed close date.

- Accounts Payable (A/P) analysis that reviews AP transactions, and ensures compliance with 1099 transitions and classifications.

- Departmental (Class) analysis. If departments are used, we conduct a basic review for potential integrity issues in classification and if they do not exist, will work with the customer to implement them (if desired)

- Historical entries by quarter for revised chart of accounts, Depreciation/Amortization, and other clean-up entries as needed. This does not include modifications to historical departmental classifications only arcount rerlassification

The BEST Tune-Up:

All the elements of the BETTER tune-up plus customized and comprehensive processes for larger, accrual-based organizations. This is recommended for any major systems changes and for all customers who follow GAAP accounting principles.

- Implementation of alternative or new third-party apps as it relates to Accounts Receivable, Accounts Payable or other applications.

- Comprehensive analysis of all prior transactions in an open period to identify issues.

- Internal control analysis of existing processes.

- Other customized, agreed-upon procedures for activities that improve the maintenance phase. Selecting which tune-up is right for your organization is something we take pride in finding the best fit.

Tune-ups can be a la carte, but we highly recommend they be paired with one of our FinTrade

Maintenance Programs.

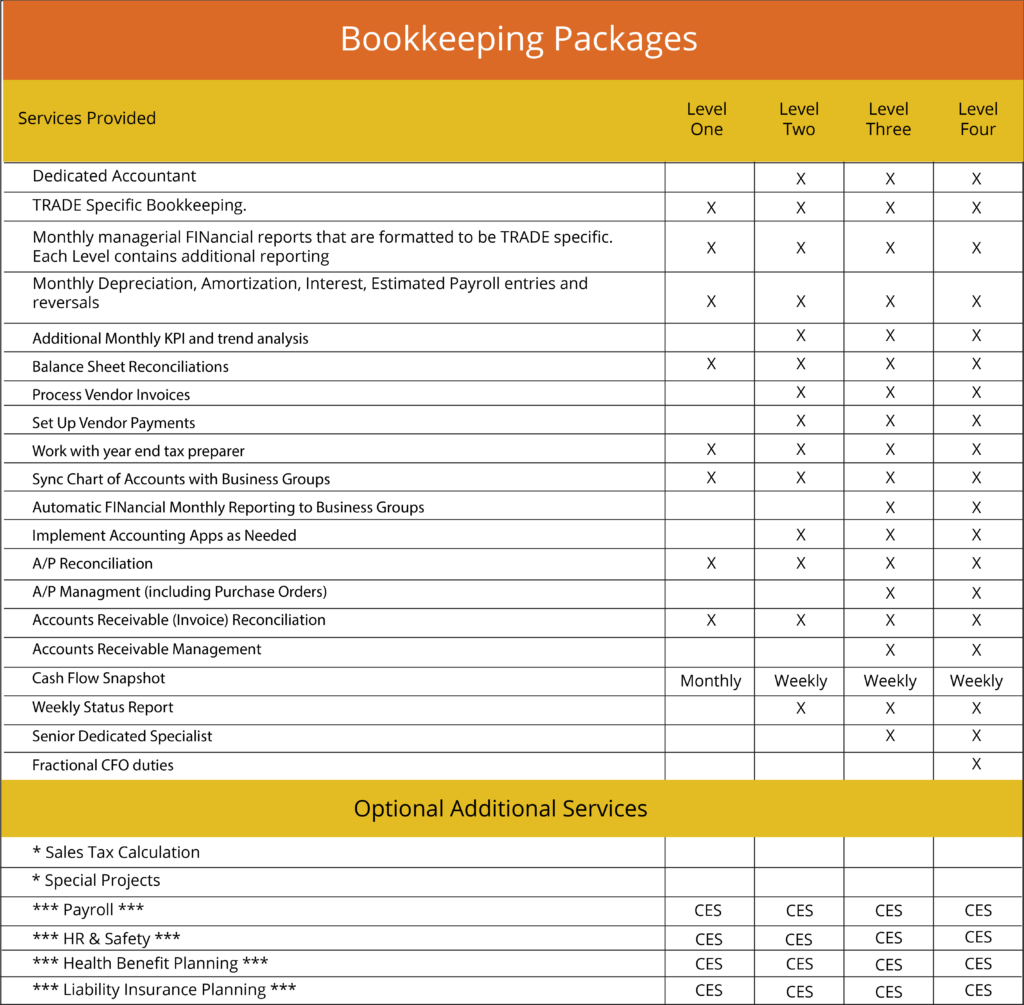

FinTrade Maintenance Program

Your books are a primary part of your financial engine and what good is a tune up if you don’t maintain that engine after? The maintenance programs offered by FinTrade are what give you all the tools for success. Whether it is customized management financial reports or cash flow forecasting, our maintenance programs are the backbone of what we do. Depending on your needs, we have four levels that we offer along with various additional services that can be added to a package or handled a la carte.

Much like the tune-up, these levels are designed to grow with your business and where you start today may not be where you go in the future.

1

Level One Maintenance

2

Level Two Maintenance

3

Level Three Maintenance

4

Level Four Maintenance

Additional Services (Optional):

At FinTradeBooks, we offer a range of additional services that can be seamlessly integrated into your financial management strategy. Our Expense Reports service ensures meticulous tracking and reporting of your business expenses, helping you maintain financial transparency. We also take care of the administrative burden by preparing 1099 forms, guaranteeing compliance with tax regulations.

For efficient cash flow management, our A/R Collections service helps you recover outstanding payments from clients, improving your liquidity. We can handle the complexities of Sales Tax Calculation, ensuring accurate and timely submissions. Moreover, our team is equipped to tackle Special Projects, addressing unique financial needs. While we are not a public accounting firm, we do work hand in hand with CPA’s and have other contacts in this area should you need CPA support.

Additionally, we extend our services to encompass critical aspects of your business through our partner Comprehensive Employment Solution Inc, including Payroll Management, Payroll Compliance, HR & Safety compliance, Health Benefit Planning, Workers Compensation and Liability Insurance Planning. These comprehensive solutions enable you to focus on your core business activities while FinTrade and CES handle the intricacies of finance, human resources, and risk management.

Which Bookkeeping Services Level is right for your Business?